Profiles will get instant access in order to exchangeability, if you are exchangeability organization (depositors on the AMM’s liquidity pond) can also be secure couch potato income thru change costs. For those who’d including a far more intricate exploration from AMMs, check this out post coating how AMMs work. A great decentralised exchange (DEX) is a kind of cryptocurrency exchange in which profiles is also perform financial transactions involving the exchange away from digital assets on the internet myself with each most other (or fellow-to-peer). Even when purchases to your decentralized transfers is pseudo-anonymous, you need to report your cryptocurrency fees.

Instances try hypothetical, and we prompt one to search custom advice of accredited benefits out of specific investment points. Our very own rates depend on prior industry results, and you will past results is not a promise of upcoming overall performance. DEX front side comes to an end and you may aggregators can get deal with regulations once they meet the requirements as the companies. In early 2025, reports told you the brand new SEC closed you to investigation instead of step. It outcome cannot place authoritative policy, nevertheless matters to help you developers and you can users. Individual trick thieves and you can front-prevent hijacks drove most losings during the early 2025.

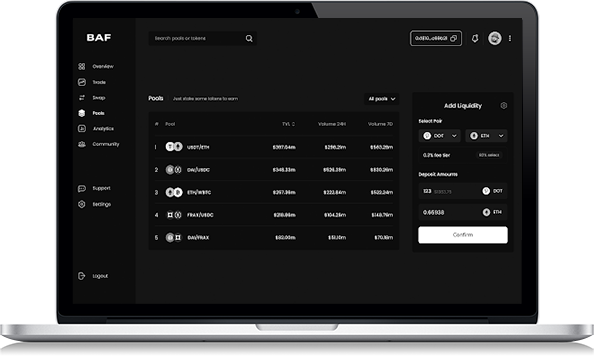

. . .

Must i have fun with fiat currency to your a great DEX?

DEXs is actually slow and less pupil-friendly, but more long lasting and private. He is shorter forgiving out of problems for example missing passwords, along with to believe that your particular purse’s resources and application are working because hyperliquidt.xyz the meant. NerdWallet, Inc. is actually an independent creator and assessment services, maybe not a financial investment advisor. Its posts, interactive products or any other blogs are provided to you free of charge, since the self-assist devices as well as educational motives just. NerdWallet doesn’t and should not make sure the precision or usefulness of any advice concerning your own personal items.

But not, you can find far more actions required whenever trade from the an excellent DEX. Such, granting a new token change, granting another connection to get into another network. One of many early explore circumstances because of it is actually the very thought of a good crypto exchange who does make it users so you can trade-in a great much more decentralized fashion.

Understanding AI tokenization is essential to have efficiently controlling and you can securing research, particularly as the AI options handle even more large and painful and sensitive datasets. Inspite of the professionals, decentralized transfers (DEXs) provides drawbacks such demanding user experience, smart deal vulnerabilities, and you may unvetted token listings. Playing with a decentralized change (DEX) might be a great way to trading cryptocurrencies, but it is necessary to be aware of the risks and you can pressures. DEXs try non-custodial, meaning profiles retain command over their funds and personal tips, reducing the chance of central weaknesses and you will research breaches.

- Diverse blockchain sites, AI architecture, and you will IoT standards expose demands for seamless combination.

- But if independence, confidentiality, and you may complete command over your own fund become more your mood, decentralized exchanges you will feel household.

- Thus buyers had been to shop for ETH and you can attempting to sell USDC from your pool.

- More identifying trait of decentralized crypto transfers is having no third parties employed in deals initiated to your including platforms.

- It overlap address simple demands encountered because of the old-fashioned cloud-founded investigation processing, for example latency, higher can cost you, and vulnerability in order to cyber threats.

- If you wish to explore one to your Solana, you need a little bit of $SOL alternatively.

Prepared to begin your crypto trip?

If or not you need antique centralized transfers or decentralized transfers, Cwallet gets the best solution. Profiles should know this type of risks or take suitable tips to safeguard its assets. But not, decentralized exchanges features their own set of risks, for example smart bargain vulnerabilities and you can liquidity items. Wise agreements, the brand new code one to governs transactions for the decentralized exchanges, may have vulnerabilities that would be exploited.

Centralized compared to. Decentralized Exchanges

For the anticipated increase away from buyers on the cryptocurrency business, it’s predictable one DEXs have a tendency to appear since the an even more influential user on the monetary land. 1inch – Some other popular DEX is 1inch, which aggregates liquidity out of numerous DEXs, getting pages for the best price because of their investments. When the to purchase Chainlink (LINK), a person tend to exchange Ethereum (ETH) to own Hook up thanks to a keen ETH/Link exchangeability pond. Smart agreements that run the brand new exchangeability pool up coming ensure the deal try direct and the reserve amounts of per money is actually upgraded. So it aligns which have Nym’s goal to build infrastructure one to defends privacy — even facing advanced surveillance possibilities.

While you are DEXs wear’t completely anonymize activity, they get rid of dependence on central investigation-picking programs. When you are unfamiliar with what so it metadata includes, the book to your “What is actually metadata? Specific, such Robinhood, manage work at additional wallets, while some don’t.

Trick Reports & Occurrences

While you are building a profitable DEX demands extreme technical solutions, neighborhood involvement, and you may navigating the fresh changing regulatory land, the possibility benefits will be generous. DEXs can offer rates efficiencies in a few parts through the elimination of dependence on the intermediaries. Furthermore, a highly-customized DEX can enhance protection by posting exposure and you can reducing single items away from incapacity. If you are decentralized transfers render of numerous high professionals more a central exchange, extensive use from DEXs isn’t gonna occur up until DEXs become finest knew and easier to use. It’s important to keep in mind that decentralized transfers remain a fairly the brand new technical. Because of this, they are not while the representative-friendly or have the same level of customer service since their centralized competitors.

Another essential advantageous asset of using an excellent DEX is that zero individual information is previously required from you (if you don’t fool around with credit cards otherwise bank to purchase crypto with these people). When you’re for the Polygon, Sharp Token combines scalability, speed, and you will entry to—so it’s an excellent project for each other merchandising and you can organization buyers examining DEX possibilities. Rachel Warren is actually a contributing Motley Fool stock exchange specialist level pharmaceuticals, biotechnology, scientific products, i . t, and user products. Before the Motley Fool, Rachel are a great paralegal and you can court officer.