. . .

Mastering Online Forex Trading: A Comprehensive Guide

Forex trading is an exciting and potentially rewarding endeavor that attracts numerous participants from all walks of life. online forex trading South Africa Brokers play a pivotal role in this dynamic market, offering various platforms and tools to help traders succeed. This article will explore the basics of online forex trading, its benefits, the strategies you can employ, and tips for choosing the right broker.

Understanding Forex Trading

The foreign exchange market, or Forex (FX), is the largest and most liquid financial market globally. Unlike other markets, it operates 24 hours a day, five days a week, allowing traders to buy, sell, exchange, and speculate on currency pairs at any time they choose.

In forex trading, currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is the base currency, and the second is the quote currency. Traders speculate on the exchange rate movements between the two currencies, with the aim of making a profit.

Benefits of Online Forex Trading

There are several advantages to engaging in online forex trading:

- Liquidity: The forex market is incredibly liquid, allowing traders to enter and exit positions with ease.

- Leverage: Forex brokers offer leverage, which enables traders to control larger positions with a smaller amount of capital.

- Accessibility: With a computer or mobile device and an internet connection, anyone can start trading forex.

- Diverse trading options: Traders can choose from a wide range of currency pairs, allowing for various trading strategies and market analysis.

- Low transaction costs: Forex trading often has lower fees than other financial markets, making it more accessible for a wide range of traders.

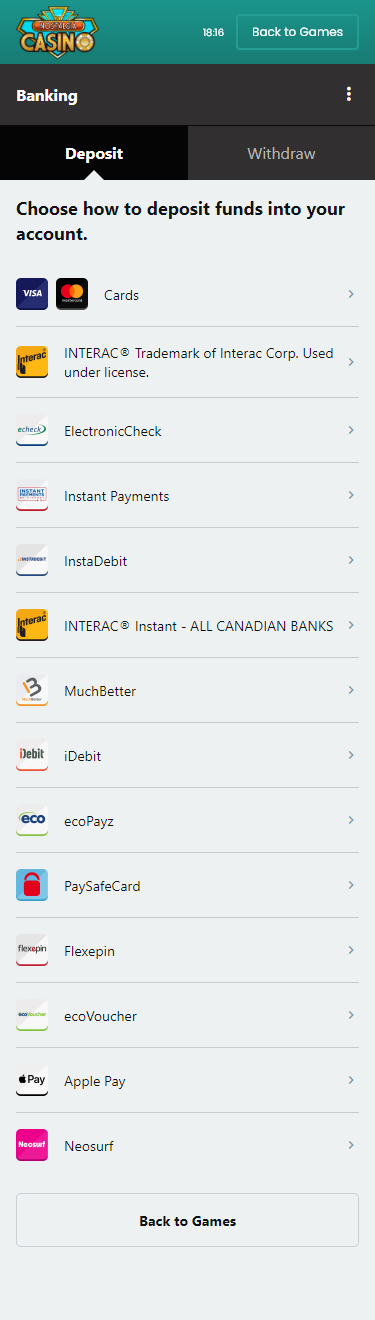

Choosing the Right Broker

Your choice of a forex broker can significantly impact your trading success. Here are some key factors to consider when selecting a broker:

- Regulation: Ensure that the broker is regulated by a reputable authority, as this adds a layer of security to your funds.

- Trading platform: A user-friendly and reliable trading platform enhances your trading experience and efficiency.

- Spreads and commissions: Compare the trading costs of various brokers to find one that offers competitive spreads and commissions.

- Customer support: A responsive and effective customer service team is essential for resolving any issues that may arise during your trading journey.

- Educational resources: Quality brokers offer educational materials, webinars, and market analysis to help traders enhance their skills.

Essential Forex Trading Strategies

Successful forex trading requires a well-thought-out strategy. Here are a few approaches that traders commonly use:

1. Scalping

Scalping involves making numerous trades throughout the day to exploit small price movements. This strategy is best suited for traders who can dedicate a significant amount of time to monitor the market and execute trades rapidly.

2. Day Trading

Day traders open and close positions within the same trading day, seeking to profit from short-term price fluctuations. This approach requires a good understanding of market trends and can be emotionally taxing due to its fast-paced nature.

3. Swing Trading

Swing trading involves holding positions for several days or weeks, aiming to benefit from larger price swings in the market. This strategy requires a more in-depth market analysis and less immediate reaction than day trading or scalping.

4. Position Trading

Position trading is a long-term approach where traders hold onto their positions for months or even years, based on fundamental analysis. This method requires patience and a solid understanding of macroeconomic factors.

Risk Management in Forex Trading

Effective risk management is essential for longevity in the forex market. Here are several strategies to manage your risk:

- Use stop-loss orders: Set stop-loss levels to limit potential losses on each trade.

- Determine position size: Calculate the appropriate position size based on your account balance and risk tolerance.

- Diversify your portfolio: Avoid putting all your capital into a single trade or currency pair. Diversification helps mitigate risk.

- Maintain a trading journal: Document each trade to analyze what works and what doesn’t, helping refine your strategy.

- Stay informed: Follow market news and events that could impact currency prices to make informed trading decisions.

Conclusion

Online forex trading offers numerous opportunities for individuals willing to learn and adapt to market conditions. By understanding the fundamentals of the forex market, selecting the right broker, employing effective strategies, and managing risk appropriately, you can enhance your chances of trading success. With dedication and practice, anyone can become a successful forex trader in this exciting and ever-evolving landscape.