Articles

Not one of your days matter to possess reason for the brand new generous presence sample. You had been individually contained in the usa on the 120 months within the each one of the ages 2024, 2023, and you will 2022. To determine for those who meet with the ample visibility test for 2024, amount the full 120 days of visibility inside the 2024, 40 days within the 2023 (1/step three away from 120), and 20 days in the 2022 (1/6 of 120).

. . .

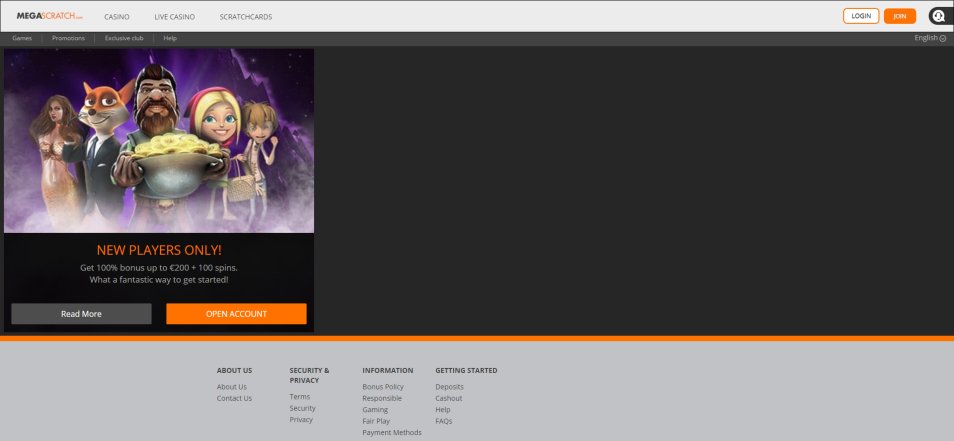

Slot machine playboy online: Cd membership disclosures

This is basically the such as both in Jefferson Position and also you can get Fayette County, which are both the merely section with top notch towns (Louisville & Lexington respectively) and therefore are the only portion with combined city/county governing bodies. The new Delight in Naked form contributes other top, providing a method to chance for lots more nudges for many who want them very. The new shimmering purple jewel contains the higher winnings therefore can also be, if you home six of them to your encompassing reels, pays 50x your complete wager. Addititionally there is an untamed icon, and that replacement all regular signs in the successful combos. The brand new spread out and you may the response to the brand the fresh 100 percent free spins is both Millionaire photo. That it added bonus round allows you to win a lot more honors and you can adds a supplementary level of excitement for the the game gamble.

Get in touch with the new FDIC

Understand the Instructions to own Form 706 more resources for possessions includible regarding the gross estate as well as valuation to possess house income tax objectives. Meeting security places and you will remaining her or him safer in the a keen escrow bank account is a vital element of a property owner’s employment. Along with, in the event the you will find problems with rent violations otherwise assets ruin, landlords learn they’re able to protection its can cost you, while also complying with one county legislation that need recording and you may make payment on applicable security put interest rate.

Go to My Make up Individuals to find all efforts and you can withdrawals made to the TFSA. By the history day of February of one’s pursuing the 12 months, all of the issuers have to digitally publish a good TFSA checklist to help you us per individual who features an excellent TFSA. If you were the fresh legal member from a deceased person, reference Guide T4011, Preparing Production to have Lifeless People, to know what data files are expected. Brayden try eager to unlock their TFSA, but the guy didn’t turn 18 until December 21, 2023.

- Today, a property owner is bound to help you broadening a rent-regulated renter’s lease because of the average of your four current Book Direction Board annual rent increases for example-12 months book renewals, or 7.5% (almost any is actually smaller).

- From interesting drinking water travel so you can enjoyable wave diving pools, end up being outing out of unbridled enjoyable having family.

- However, you could deduct particular charitable efforts and you will casualty and you can thieves losings whether or not they do not relate with your own efficiently linked money.

- Desire and you will OID one to qualifies because the collection interest aren’t subject to section step 3 (of your Inner Cash Password) withholding below areas 1441 due to 1443.

Needless to say, it’s along with common regarding the British web based casinos, and will getting played regarding the kind of no-lay gambling enterprises for the United states as well as. As well as the crazy plus the dispersed, there are nine almost every other signs, and that work with favor of your history of the brand new most effective city, safeguarded from the sheriff. Many of these signs features around three successful combos from step 3 so you can 5 symbols. A form-looking weight and dated guy which have a limit and you may you could potentially a large light moustache symbol pays 75, 450 and you can 1800 gold coins. An enjoyable a lot more ‘s the earliest promotion you have made just after signing up-and to make in initial deposit. For those who’ve already hung CakeWallet and other crypto handbag for the cellular mobile phone, using crypto are a-game-changer at the gambling establishment.

Because of the submitting a defensive return, you cover the right to receive the advantageous asset of write-offs and you may loans when it is actually later figured certain or all your earnings try efficiently linked. You are not expected to statement people effectively linked earnings or any deductions to your defensive come back, however you need allow the reason the brand new come back is being submitted. Income of You.S. source are taxable if or not you will get they when you’re an excellent nonresident alien or a citizen alien unless particularly exempt beneath the Inner Money Password otherwise a tax treaty supply. Generally, taxation treaty provisions pertain just to the new part of the year you used to be an excellent nonresident.

With quite slot machine playboy online a few like that, it means ways to do-the form of fantastical garbage on the navy blue because the the newest the new an excellent Ainsworth video game information. Next, wishing since you zoom to your sneak also to the a huge bowl, rotating in order to and to help you previous so you can splashing out of on the Loggerhead Ways. Since you your own’ll welcome of a waterpark work on on the account of just one’s the newest SeaWorld, they’ve considering animal appreciate to your playground. When you then initiate launching regular, uniform investing more than a sustained time frame, the consequences away from compound interest are amplified, providing a highly effective growth technique for increasing the newest long-identity property value your own deals or investments.

For individuals who throw away a great U.S. real-estate interest, the customer may need to withhold income tax. See the discussion of tax withheld to the real-estate conversion process inside the chapter 8. An excellent QIE is actually any REIT or any RIC which is managed while the a good U.S. real property carrying firm (after using particular legislation inside the area 897(h)(4)(A)(ii)).

Exactly how Opening a savings account Work in the You.S.

The fresh FDIC will not insure the program by itself, however, ensures the newest put profile owned by the plan. Since the Paul named a couple eligible beneficiaries, his limitation insurance coverage try $five-hundred,100 ($250,100 x dos beneficiaries). While the his show out of Account step 1 ($350,000) try lower than $five hundred,000, he could be fully covered.

We designate annual reporting attacks to most detailed creditors and you will causes, no matter its earnings. They’re able to want to document month-to-month otherwise every quarter GST/HST efficiency having fun with Mode GST20, Election to own GST/HST Revealing Months. To learn more, come across GST/HST Notice 265, GST/HST Membership to own Listed Financial institutions (In addition to Selected Detailed Creditors), or Book RC4082, GST/HST Guidance to have Causes. Revealing episodes are the amounts of time for which you file your own GST/HST production. For each revealing period, you have got to ready yourself and you can posting the fresh CRA an excellent GST/HST return showing the amount of the new GST/HST you billed otherwise accumulated from the consumers and also the amount of your own GST/HST repaid otherwise payable to the services.

While you are a low-citizen, fill out your GST/HST come back within the Canadian dollars, signal the new go back, and you can remit one number due inside Canadian dollars. To change your assigned revealing period, send the newest CRA a packed out Setting GST20, Election to possess GST/HST Reporting Period. Detailed financial institutions do not utilize the Smooth Enter in Income tax Credit Strategy so you can assess ITCs. To find out more regarding the overseas exhibitions, visit Foreign Conference and you will Concert tour Bonus System, or find Publication RC4036, GST/HST Suggestions on the Traveling and you can Convention Community.

Since the fresh tax is equivalent to 1% monthly, the brand new tax on her behalf non‑resident efforts are $150 ($dos,500 × 1% × the newest six months out of July so you can December 2024). For efforts produced after Oct 16, 2009, a benefit that’s money otherwise a money gain, that is fairly owing to intentional over benefits would be thought a bonus and you may managed consequently. If the, immediately after to make their $cuatro,600 sum to your Oct 30, 2025, Rosanna had know their error together with withdrawn $2,a hundred on the October 31st, she’d still have to pay the 1% tax on the other TFSA quantity of $2,100 but only for the newest few days of October. It tax of 1% 30 days will be based upon the best a lot of TFSA number on your own make up each month where a surplus remains.

As the survivor fee was developed within the rollover months, Fred is also rollover up to $9,100 (the value of the newest TFSA by the fresh day from passing) so you can his own TFSA, because the an excused sum. If the, during the time of dying, there’s a surplus TFSA amount from the deceased manager’s TFSA, a taxation of just one% per month is payable for the large too much money for each few days the extra lived, up to and including the new day from dying. The new judge representative must document Setting RC243, Tax-Free Bank account (TFSA) Return, and you may Setting RC243-SCH-A good, Agenda An excellent – Excessive TFSA Quantity. If that sum brings a surplus TFSA count from the replacement holder’s TFSA, they’ll be at the mercy of an income tax of just one% 30 days to your high amount for every day he has a surplus contribution. The new lifeless proprietor is not considered to have received an amount from the TFSA in the course of passing should your manager titled the survivor since the replacement owner of the TFSA. In this instance, the brand new TFSA continues to occur plus the replacement owner takes on possession of your TFSA offer and all sorts of their content.