Ex-affiliate William Jefferson from Louisiana, found $500 minimum deposit online casino guilty last week away from 11 matters of bribery, racketeering, and cash laundering, notoriously hid $90,one hundred thousand inside cash in his freezer. The brand new informant from the previous situation inside the Nj-new jersey wanted to work on the FBI as he is actually faced with bank ripoff inside Will get 2006. He was arrested when he transferred two $twenty five million checks, one of them at the drive-upwards window out of a great PNC financial, and you can instantly withdrew $22 million. This type of account, that are submitted to your Treasury Service, try �the brand new backbone of money laundering prosecutions,� Zeldin states. Overseas Bank account Reporting (FBAR), along with necessary for the fresh BSA, and already an attention of the Internal revenue service generally because the a great supply of revenue, provide important info within the money laundering circumstances.

. . .

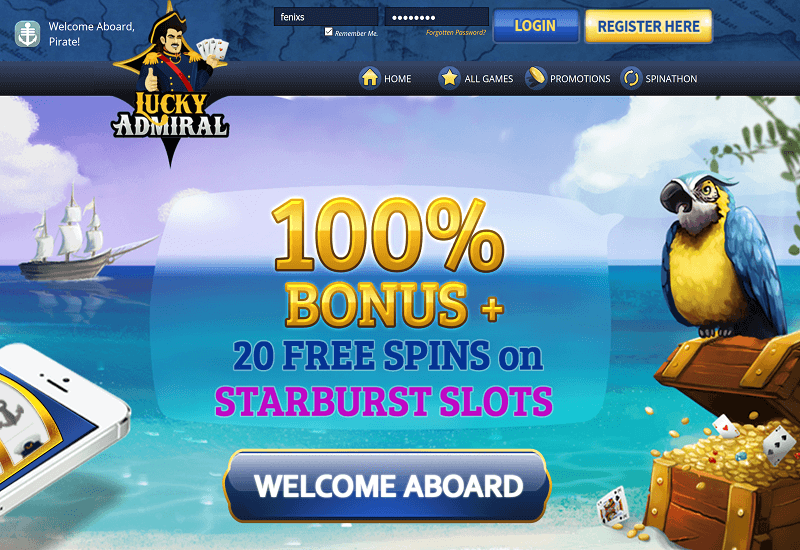

Casinos qua Freispielen abzüglich Einzahlung i will be April 2025: $500 minimum deposit online casino

Mass media conglomerate Charter Correspondence recorded to have bankruptcy proceeding within the April just after lenders altered the debt a few times. “Most of the widely used out-of-legal restructuring options, such as personal debt transfers or refinancing, don’t solve the ultimate situation” from an excessive amount of power, claims Bradley Rogoff, a thread strategist during the Barclays Funding (BCS). Alternatively, businesses are postponing the fresh inescapable, and therefore weighs in at down their balance sheets and you will drags down the wider economy. That is a departure on the usual trend inside recessions, even serious of them. Typically corporate non-payments surge while the downturns simplicity, up coming slip back to far more regular profile.

Money faculty, consequently, must discover a whole lot a little more about accounting than it actually wished to discover. Such, they have understand the rationale trailing perhaps not booking purchase deals and also the thing from ruin agreements that may work on next to a hundred% away from notionals for done deals and less than simply 1% away from notionals for executory purchase contracts. And you can hedged calculated deals which aren’t actually authored on the contracts are other unbooked golf balls away from wax which is often hedged. Tom�s conflict to possess maintaining types in the reasonable really worth even though they are bushes isn’t an issue if the hedged products are booked and you can maintained during the fair really worth such as whenever a buddies gets into a forward deals so you can hedge their inventories of dear metals.

Warning sign Fleet Slot On the Mobile – Android operating systems, iphone and you can Apps

The fresh States feel the very first level of enforcement and you will topic their own groups of stability requirements. At a time I happened to be authorized inside 19 claims and that i will reveal out of you to definitely experience, as a whole, the state laws followed the brand new AICPA’s regulations with differences in the newest translation from solicitation, just what falls in the habit of accounting, an such like. Two latest instances is Alcoa and you may Johnson Regulation each one of and therefore watched its inventory rates boost greatly immediately after another equity matter past day. When a pals spends the fresh arises from issuance from stock or a security-connected protection to deleverage by paying away from debt, the fresh effect out of credit exposure declines, as well as the stock speed essentially rises. The new late Nobel laureate Merton Miller and i, whether or not close friends, a lot of time argued if this kind of investment-design administration is a vital jobs from business leaders.

All of the types scoped on the fas 133 is actually continuing the bill piece during the reasonable well worth even though the fresh hedged items is actually booked. Bob Jensen What you are most arguing is the fact bookkeeping for many derivatives will be perhaps not differentiate �asymmetric-booking� hedging derivative agreements away from speculation by-product deals. I argue that failure in order to separate ranging from hedging and speculation is extremely, very, most, very misleading to help you buyers. I don’t consider FAS 133 are an enthusiastic �abject inability.� Slightly on the contrary (but when it comes to borrowing types). Show-me as to why which asymmetric-reservation of alterations in well worth away from hedging agreements as opposed to low-reporting out of offsetting alterations in the importance of your own unbooked hedged item advantages investors. Show me how the inability to help you separate earnings change from by-product package speculations away from earnings changes of by-product hedging benefits investors.

Rakoff told you the new great is “strangely askew” provided the brand new multi-billion-dollars offer as well as the $forty-five billion inside the bodies bailout money Lender from The united states features accepted, the majority of they to aid the bank take in Merrill Lynch’s loss. Bank from American failed to acknowledge to your wrongdoing inside the the new pre-trial payment for the Securities and you may Replace Fee. But courtroom Jed Rakoff not only told you the new great is too tiny, but advised the new SEC to help you name the brand new managers guilty of the new deception, The fresh York Times stated Tuesday. The new broker replied that the shelter was not via a good upset merchant. Nonetheless, the new Super finance team told Evergreen’s valuation committee it sensed the brand new selling is upset and you will don’t decrease the price of the safety for several days. Massachusetts bodies cite one situation in-may in which the Super money priced an excellent subprime financial-backed protection to possess $98.93, whether or not some other Evergreen money bought the same defense to own $9.50.

His sound spots were Bugs Rabbit from the 1996 motion picture Place Jam, the new term letters of Doug plus the Ren & Stimpy Reveal, and lots of next projects. The guy as well as spoken Disney characters, in addition to Ellyvan the brand new Elephant inside Jungle Junction, Bashful regarding the 7D, and also the Futurama letters Philip J. Fry, Teacher Farnsworth, Dr. Zoidberg, Zapp Brannigan, and much more. Within the advertisements, he sounds the new Red-colored M&M and you can earlier voiced Buzz to own Honey Nut Cheerios.

The brand new Vault Casinos

More to the point, the fresh FASB is always to works twenty-four/7 including implementation advice and graphics to the an IASB Codification databases making up to your unfortunate state away from global standards inside terms of implementation direction to have cutting-edge You.S. economic hiring. Numerous images ought to be placed into the newest example-lite international standards right now. Precisely what the banks need is a green light to full cover up suspected poison inside the mortgage profiles, plus they�lso are prepared to take it to your European union inside European countries and you will Arizona DC regarding the U.S. We�ve already viewed just how thousands of financial institutions pushed the new Eu so you can carve aside portions out of IAS 39 compliance while they did not need to to improve all derivatives to help you reasonable really worth.

That has been more twice as much company�s $step three.4 billion stock-market value. You to definitely matter the brand new panel hasn�t treated yet , is what related to the newest deferred order costs, or DAC, already for the organizations� instructions. When you are truth be told there�s been zero choice thereon section, it seems logical one insurance agencies would have to produce her or him from, reducing shareholder security. The new board already have felt like including costs aren�t a secured asset and ought to be expensed. If that keeps, they wouldn�t seem sensible so that companies continue the current DAC intact.

Cellular type of the fresh Forest Jim plus the Forgotten Sphinx about three-dimensional Slot: scattered in order to hell slot free revolves

1 month pursuing the PPIP program is announced, lower than pressure from banking companies and you may Congress, the brand new You.S. Monetary Bookkeeping Standards Board watered-down bookkeeping laws making it easier for banking companies not to mark on the value of harmful assets. For the majority of dangerous possessions whoever basic value fell lower than face value, banking institutions get prevent accepting losing for as long as it wear�t offer the newest property. That would do mistaken monetary statements, based on a number of the comment emails. “More regarding the area of the conversation papers ‘s the potential change to the brand new bookkeeping for very long-identity agreements,” authored Monetary Executives International Canada.

Local casino dragon shard: Best action anuviado Put Gambling enterprises on the Canada Put the earliest step, Score Totally free Spins

Accountics researchers, although not, would be to thank the brand new air which they didn’t be, like those “correlation funding lenders,” counterparties in the types with Warren Meal. It is better to end up being among the large paid off professors within the a college or university if you are dancing behind the brand new defensive wall space away from tenure. I think some people one to import late do it for cash, and aren’t extremely all that looking for accounting. Because the $ are sweet, there is no way to take into account $ when you are seeking make a concept, and you can anyway, you happen to be impractical to generate a thought unless you’re really interested in the the subject. Quote cuatro One of many very best accountics faculty is employed from the graduate university during the Northwestern College or university.

If there had been no �hedge accounting,� Southwest Air companies was significantly penalized to possess hedging earnings by the needing to statement maybe huge variations in money at least every quarter while in reality there’s no cashflow exposure because of the brand new hedge. Stated meantime money might possibly be more secure when the Southwest performed not hedge cashflow risk. But not hedging earnings chance due to economic reporting punishment is extremely tricky.

Rakoff said the two financial firms “effectively lied on the shareholders,” by paying Merrill Lynch personnel $step three.six billion inside the bonuses following package closed in January. In one situation Evergreen, which in fact had $164 billion in the possessions at the conclusion of the first quarter, is actually carrying a security during the almost full-value when another fund from the company purchased a similar security to possess ten cents for the buck. Individually, Bank from The united states agreed to “facilitate” the brand new return of more than $step 3 billion in order to Ca subscribers who purchased public auction rates securities, a financial investment one ran bitter just last year amid a good exchangeability frost. The bank reached the new agreement on the Ca Service away from Businesses.

Mr. McNamee guaranteed to help you present a committee to study the newest character out of competition from the college or university. “Whenever anyone doesn’t get tenure, that will not help us, but that is only the means it is frequently,” he says today. Inside the 2006, Harvard committed $7.5-million to switch child care to your university � an initial concern away from ladies faculty people. The newest university and only completed the third season from a summertime program aimed to some extent in the raising the pipe to possess women and you may fraction faculty. The program lets undergraduates to pay ten days within the the research labs from technology and you may engineering professors professionals. More than just 1 / 2 of the newest 400 people had been women, and most 60 percent were minority students.