. . .

Unmasking Forex Trading Scams: How to Protect Your Investments

Foreign exchange (Forex) trading has gained immense popularity over the last decade, attracting millions of retail investors seeking to profit from currency fluctuations. However, this booming industry is also a fertile ground for scams and fraudulent activities. Many unsuspecting traders fall victim to these scams, resulting in significant financial losses. In this article, we will explore the common types of forex trading scams and offer tips on how to protect yourself. For those looking for legitimate options, consider exploring forex trading scams Turkish Trading Platforms that can guide you through your trading journey.

Understanding Forex Trading Scams

Forex scams can take many forms, and they often target the emotions of traders, such as greed and fear. These scams may promise unrealistic returns, use high-pressure sales tactics, or require upfront fees for education or software that rarely deliver on their promises. Understanding the characteristics of these scams is the first step in protecting your investments.

Common Types of Forex Trading Scams

1. Ponzi Schemes

In a Ponzi scheme, returns are paid to earlier investors using the capital of newer investors rather than from profit earned by the operation of a legitimate business. Eventually, when it becomes difficult to recruit new investors, the scheme collapses, leaving later investors with substantial losses.

2. Signal Selling Scams

Signal sellers offer trading advice and strategies, often claiming to have outstanding success rates. However, many of these services are unregulated and provide misleading information. Traders often receive little to no value for their subscription fees, leading to further financial losses.

3. Fake Brokers

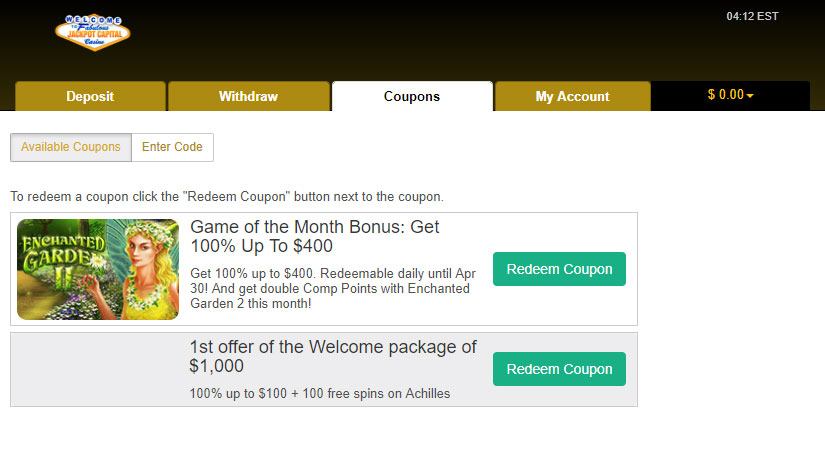

Some scams involve fraudulent brokerage firms that lure traders with promises of high leverage, low spreads, and bonus offers. Once a trader deposits funds, the broker may manipulate prices, limit withdrawals, or disappear entirely. Researching a broker thoroughly and ensuring they are regulated can reduce the risk of falling for this scam.

4. Educational Scams

While education is critical in forex trading, some companies exploit aspiring traders by offering overpriced courses and coaching, often with little actual value. Many of these programs focus on marketing hype rather than actionable strategies. Be skeptical of any program promising instant success in trading.

5. Automated Trading Systems

Automated trading systems often claim to use advanced algorithms to generate profits with minimal effort from traders. Some of these systems may be effective, but many are designed to enrich the developers rather than the users. Beware of any system that guarantees specific returns, as trading always involves risk.

Signs of a Forex Trading Scam

Identifying potential scams can save you significant time and money. Some common red flags include:

- Promises of guaranteed returns with little to no risk.

- High-pressure sales tactics that urge you to invest immediately.

- Illogical trading strategies that go against established market principles.

- Unregulated brokers or trading platforms.

- Unrealistic claims of historical performance.

Protecting Yourself from Forex Trading Scams

Investing in forex trading can be lucrative, but it is essential to undertake due diligence to protect your investments. Here are some strategies to help you avoid scams:

1. Research Your Broker

Before choosing a broker, verify their regulatory status. Reputable brokers are typically regulated by recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. An unregulated broker poses a higher risk of fraud.

2. Be Wary of Promotions

While bonuses and promotions can be enticing, they may come with strings attached. Understand the terms of any offers and be cautious of brokers that require large deposits to access these promotions.

3. Educate Yourself

Invest in quality education from reputable sources. Learn the fundamentals of forex trading, including technical and fundamental analysis, risk management, and market order types to build a solid foundation.

4. Start Small

When beginning your trading journey, start with a demo account or a small trading account to minimize your risk. This approach allows you to test strategies without significant financial exposure.

5. Keep Emotions in Check

Avoid trading based on emotions such as fear and greed. Stick to your trading plan and set realistic goals. Maintaining discipline can prevent you from making impulsive decisions that lead to losses.

Conclusion

The allure of forex trading can sometimes overshadow the risks involved, particularly the threat of scams. By understanding the various types of forex trading scams and taking proactive measures to protect yourself, you can engage in trading with greater confidence. Always conduct thorough research, educate yourself, and remain vigilant to safeguard your investments. In the end, your financial security and the preservation of your hard-earned money depend on your ability to identify threats in the forex space.